Changes are afoot in our house. My husband and I recently reviewed our split of financial tasks and decided to revise who is responsible for what.

Just because I counsel people on issues of financial self-care doesn't mean these processes are always perfect in my own life. I probably have more than my share of quirks and blind spots -- why do you think I went into this business in the first place?

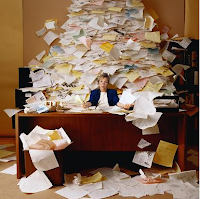

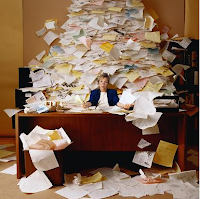

So I begin with a confession: I have fallen down a rabbit hole. I sit here surrounded by multiple stacks of open files. I have two online accounting programs open, as well as a now-four-page Excel workbook. I'm totally over-caffeinated and I've been in this chair for five hours.

It's not uncommon for large financial initiatives to inspire manic bursts of effort. But problems arise when we let our mania run the show. I started out on one small task -- creating a simplified family budget -- but then I had to look up some insurance info in our files. That led to reviewing policies. Then I opened

Mint to look at numbers for shopping and groceries. This led to a hyper-detailed tagging project. Then I wanted a clearer idea of how much our daughter's activities cost per year, so I started pulling data going back several months.

Somebody help me!

Large financial tasks require structure. They require a goal, sub-tasks, and a time line. When you jump in with only a hazy idea and a Venti-sized twitch in your fingers, it's too easy to get into trouble. You start off strong, then you run into a snag, and then you get distracted, and then you start something else, until finally you're waist-deep in fifteen different projects with nothing actually accomplished. The cycle ends when you run out of time or energy, and the emotional imprint that's left on this experience is one of frustrated depletion. What's even worse, you've left the task in such a state of mess that it's hard to find the thread to pick it up again later.

If I were to be my own client here, this is what I would advise:

Set a start time and an ending time.

You never want to make your level of motivation the key determinant of task structure. This morning I was filled to the brim with motivation. I couldn't wait to get started! But five hours in I had exhausted myself. I'm walking away from the task feeling terrible. My motivation for picking it up later to continue the work? Not high, my friends. I've created an association between this project and feeling crappy about myself. That emotional association is going to make it more difficult to resume the task and see it through to completion. To create a positive emotional association, you want to structure the task such that you walk away with some motivation still in your tank. Then, next time, you'll be excited to jump back into it.

Make 'Create a Clear Plan' the first sub-task.

My simplified family budget idea was too vague. What's the purpose of said budget? What does "simplified" mean? Knowing that I have a visual

learning style, I should have sat down with a blank piece of paper and sketched out exactly what it was that I wanted to figure out, what resources (information) I would need to do it, how long it would take and when I planned to do it. Only then should I have allowed myself to touch the computer or filing cabinet.

Make 'Organize the Project for Next Time' into the last sub-task.

Have you ever seen a contractor at work on a big construction project? It may seem like a waste of time (and your money) when they start putting everything away at 3:00 in the afternoon, but the truth is that ongoing jobs require careful organization for each phase of progress. Along with setting an end-time for today's work, I should have also allotted time to tidy up and put things away in some sort of order. Looking out at my sea of files, I want nothing more than to just dump them all in a drawer and never open it again.

Put the project away and do something rewarding.

Okay, so I was not good at these first three, but my reward today was to vent a little by writing a slightly whiny blog post. There is also a very good chance that as I type this I'm sitting here with a generous bowl of ice cream. And I'm totally watching

The Closer as soon as I wrap this up.

Review of process is the only way we learn to do things better. The good thing about financial tasks is that they are a regular part of life. I am going to get many, many, many opportunities to work on this some more, and when I do I am going to follow my own advice.

Look at that amazing picture of me on the cover of this month's Women's Health magazine!

Look at that amazing picture of me on the cover of this month's Women's Health magazine!